We are discussing Figuring out the (NPCI) National Payments Corporation of India: Reforming Digital Transactions. Information Technology (IT) has emerged as the backbone of the modern digital landscape, revolutionizing how we live, work, and communicate. In this comprehensive exploration, we delve into the full structure of IT, its evolutionary journey, and its pivotal role in shaping the technological landscape of the digital age.

We are discussing Figuring out the (NPCI) National Payments Corporation of India: Reforming Digital Transactions:

Prologue to NPCI

In the domain of computerized exchanges in India, the Public Installments Organization of India (NPCI) remains a signal of development and effectiveness. Laid out in 2008 by the Reserve Bank of India (RBI) as an umbrella association for working retail installments and settlement frameworks in India, NPCI had a crucial impact in changing the country’s installments scene. With a mission to give open, reasonable, and secure installment arrangements, NPCI has presented a few weighty drives that have changed how Indians execute carefully.

Establishment and Targets of NPCI

The commencement of NPCI denoted a critical achievement in India’s excursion towards a credit-only economy. Its essential targets are to cultivate development for installment frameworks, guarantee the openness of electronic installment offices to all sections of society, advance rivalry and proficiency in installment frameworks, and work with the improvement of a vigorous installment foundation in the country.

National Payments Corporation of India’s Key Drives and Items

National Payments Corporation of India has presented an assorted scope of installment items and administrations, each taking care of explicit necessities and inclinations of clients across various fragments of society. A portion of its lead drives include:

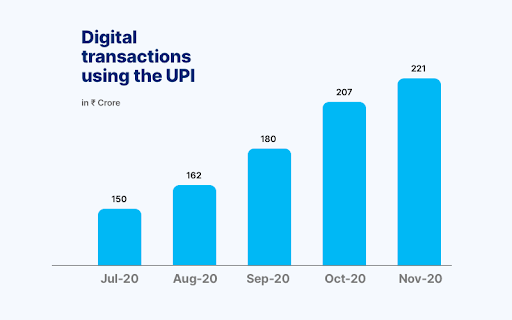

1. UPI: UPI is perhaps the National Payments Corporation of India’s most progressive item, empowering moment reserve moves between financial balances utilizing cell phones. With its basic, consistent, and interoperable system, UPI has seen outstanding development since its send-off, changing one individual to another (P2P) and individual-to-dealer (P2M) exchanges.

2. IMPS: Demons work with continuous interbank electronic asset moves through cell phones, web banking, and ATMs. It has arisen as a favored decision for people and organizations for its speed, comfort, and accessibility nonstop.

3. BBPS: BBPS offers a unified bill installment stage that empowers buyers to cover different service bills, including power, water, gas, and telecom, under one rooftop. It improves bill installment processes, upgrades productivity, and lessens the requirement for actual visits to charge installment focuses.

4. NETC: NETC, or FASTag, changes the cost installment framework on expressways by empowering the programmed derivation of cost charges as vehicles go through cost courts. It advances consistent traffic stream, decreases clogs, and upgrades straightforwardness in cost assortment.

5. RuPay Card: NPCI’s RuPay card conspire gives a homegrown option in contrast to global installment organizations, offering charge, credit, and pre-loaded cards acknowledged at ATMs, retail location (POS) terminals, and web-based business sites across India. It means advancing monetary incorporation by giving reasonable and open installment answers for all fragments of society.

Effect and Importance of NPCI

The expansion of NPCI’s drives significantly affects India’s computerized installment environment. It has democratized admittance to monetary administrations, enabled many people and organizations, and sped up the speed of advanced reception the nation over. NPCI has encouraged solid contests among banks and fintech organizations by advancing interoperability, driving advancement, and improving help quality. In addition, the National Payments Corporation of India‘s accentuation on security and dependability has supported trust in advanced installments, moderating worries regarding misrepresentation and network safety gambles.

Difficulties and Future Viewpoints

Despite its beautiful accomplishments, the National Payments Corporation of India faces a few challenges in facilitating monetary consideration and extending the range of computerized installments. Issues, for example, foundation holes, last-mile networks, and online protection dangers, require consistent consideration and venture. Besides, NPCI should stay lithe and versatile in developing business sector elements, innovative headways, and administrative changes to support its development energy and significance.

NPCI is ready to assume a much more critical part in molding India’s computerized economy. With an emphasis on development, inclusivity, and flexibility, NPCI will keep presenting state-of-the-art arrangements, reinforce organizations, and drive monetary strengthening across the length and broadness of the country.

FAQs

What is NPCI and its part in India’s monetary ecosystem?

NPCI represents the National Payments Corporation of India. It is an association laid out by the Save Bank of India (RBI) to work retail installments and settlement frameworks in India. NPCI is critical in creating and overseeing different computerized installment stages and drives toward advancing monetary consideration and productivity in the Indian monetary biological system.

What are a portion of the critical drives and items presented by NPCI?

NPCI has presented a few lead drives and items, including:

- UPI

- IMPS

- BBPS

- NETC or FASTag

- RuPay Card

What is UPI, and how can it work?

UPI is a continuous installment framework that works with moment store moves between ledgers utilizing cell phones. It permits clients to send and get cash, take care of bills, and make online purchases, and that’s just the beginning, straightforwardly from their financial balances. UPI works interoperably, empowering consistent exchanges across various banks and installment specialist organizations.

How secure are exchanges directed through NPCI’s platforms?

NPCI puts areas of strength on security and utilizes different measures to protect exchanges. These incorporate encryption, multifaceted validation, exchange limits, misrepresentation checking frameworks, and cooperation with banks and administrative specialists to battle extortion and online protection dangers.

What is the meaning of RuPay Card in NPCI’s offerings?

RuPay Card is a native installment card plot acquainted by NPCI with a homegrown option in contrast to global installment organizations. It offers charge, credit, and pre-loaded cards acknowledged at ATMs, POS terminals, and online dealers across India. RuPay Card means to advance monetary incorporation by offering reasonable and open installment answers for all portions of society.

How does NPCI add to monetary consideration in India?

NPCI’s drives assume an urgent part in cultivating monetary consideration by giving open, reasonable, and effective installment answers for underserved portions of society. By utilizing innovation and advancing interoperability, NPCI empowers people and organizations, even in far-off regions, to benefit from banking and installment benefits.

What are some of the difficulties NPCI faces in its operations?

NPCI faces difficulties, for example, foundation holes, last-mile network issues, online protection dangers, and administrative consistency prerequisites. Tending to these difficulties requires a ceaseless interest in innovation, framework, and ability, alongside coordinated effort with partners to guarantee the versatility and dependability of its installment frameworks.

How does NPCI add to India’s objective of becoming a credit-only economy?

NPCI’s drives advance the reception of computerized installments, lessen dependence on money, and drive monetary consideration. By offering helpful, secure, and interoperable installment arrangements, NPCI enables people and organizations to embrace computerized exchanges, adding to India’s vision of a credit-only economy.

Conclusion

The Public Installments Enterprise of India (NPCI) has arisen as an impetus for change in India’s installment scene, spearheading creative arrangements that have changed how Indians execute carefully. Through its different scope of items and administrations, NPCI has democratized admittance to monetary administrations, advanced monetary consideration, and pushed India towards a credit-only economy. As NPCI proceeds to advance and improve, its commitments to India’s monetary development and advancement are ready to stay significant into the indefinite future.