Introduction

Tax Accountant assists in the maintenance and preparation of tax-related items to include tax records, tax returns, tax schedules, and related tax reports. Helps with the preparation of local, state and federal level returns to be submitted within specified tax deadlines. In this article we have mentioned about Tax Accountant Salary in US, their average base salary, their total income and many more.

Being a Tax Accountant may require a bachelor’s degree. Typically reports to a supervisor or a manager. The Tax Accountant works on projects/matters of limited complexity in a support role.

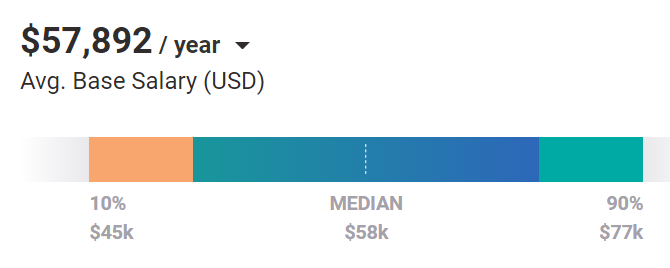

Tax Accountant Salary in US is averaged around $57,892 USD as of 2022 with typical experience

Work is closely managed. To be a Tax Accountant typically requires 0-2 years of related experience.

Tax accountant duties and expectations

Your responsibilities as a tax accountant depend on your experience level. In entry-level tax accountant jobs, you can expect to do these tasks:

- Assisting with tax preparation

- Researching tax laws and regulations

- Maintaining tax records

- Providing assistance during tax audits

- Administering the tax compliance calendar

- Responding to notices from tax authorities

Candidates for the tax accountant position must possess a bachelor’s degree in accounting. Employers also look for candidates who have excellent organizational, research and communication skills.

If you recently graduated and you’re aiming for an entry-level tax accountant job, know that relevant work experience earned during college will make your resume more attractive to hiring managers.

How much does a Tax Accountant make in the United States?

The average Tax Accountant salary in the United States is $61,114 as of September 26, 2022, but the range typically falls between $55,023 and $68,220.

Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

Tax Accountant Salary Details

Tax accountant Average base salary

$66,328

The average salary for a tax accountant is $66,328 per year in the United States. 2.4k salaries reported, updated at September 14, 2022.

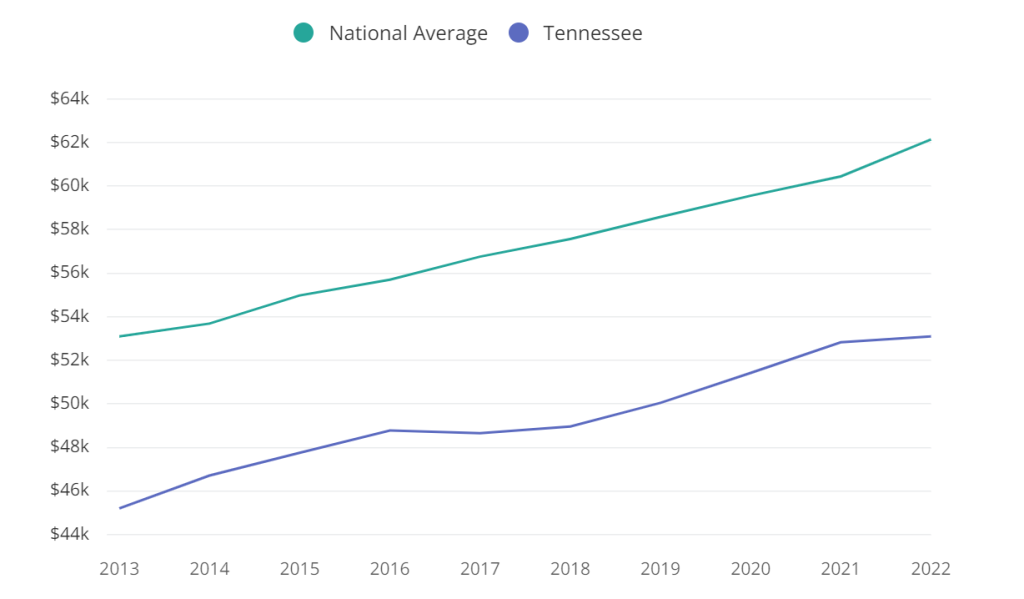

Tax Accountant Salary Over Time

What Is A Tax Accountant Salary?

| Percentile | Annual Salary | Monthly Salary | Hourly Rate |

|---|---|---|---|

| 90th Percentile | $83,000 | $6,917 | $40 |

| 75th Percentile | $72,000 | $6,000 | $35 |

| Average | $62,142 | $5,179 | $30 |

| 25th Percentile | $53,000 | $4,417 | $25 |

| 10th Percentile | $45,000 | $3,750 | $22 |

What type of tax accountant salary could you earn?

Below is an overview of average starting salaries for various tax accounting roles in corporate accounting and public accounting in 2022, based on research for our latest Salary Guide.

These are salaries that candidates with average experience and most of the necessary skills for the job could expect to earn. The role also may be in an industry where competition for talent is moderate.

Corporate accounting

- Entry-level tax accountant: $56,500

- Tax accountant (1-3 years of experience): $76,000

- Senior tax accountant: $93,250

- Tax manager: $119,000

Public accounting

- Entry-level tax accountant: $50,250

- Tax accountant (1-3 years of experience): $61,500

- Senior tax accountant: $75,500

- Manager of tax services: $110,000

Tax Accountant Average Salary By State

| Rank | State | Avg. Salary | Hourly Rate | Job Count |

|---|---|---|---|---|

| 1 | District of Columbia | $96,412 | $46.35 | 247 |

| 2 | Connecticut | $71,080 | $34.17 | 417 |

| 3 | Massachusetts | $72,326 | $34.77 | 812 |

| 4 | Rhode Island | $65,213 | $31.35 | 116 |

| 5 | New Jersey | $73,756 | $35.46 | 526 |

| 6 | Illinois | $62,293 | $29.95 | 1,332 |

| 7 | Virginia | $68,138 | $32.76 | 675 |

| 8 | New York | $78,256 | $37.62 | |

| 9 | Delaware | $62,721 | $30.15 | 109 |

| 10 | Texas | $59,939 | $28.82 | 1,811 |

Tax accountant Best paying Cities

- New York, NY

$76,949 per year

126 salaries reported

- Irvine, CA

$72,299 per year

25 salaries reported

- San Diego, CA

$71,234 per year

13 salaries reported

- Denver, CO

$70,854 per year

30 salaries reported

- Philadelphia, PA

$70,071 per year

8 salaries reported

- Houston, TX

$67,852 per year

77 salaries reported

- Phoenix, AZ

$67,737 per year

25 salaries reported

- St. Louis, MO

$67,033 per year

15 salaries reported

- Ann Arbor, MI

$65,275 per year

5 salaries reported

Tax Accountant Salary By Experience Level

| Experience Level | Avg. Salary | Hourly Rate |

|---|---|---|

| Entry Level | $41,100 | $19.74 |

| Mid-Level | $59,100 | $28.44 |

| Senior Level | $100,000 | $48.10 |

Tax Accountants Highest Paying Industries

| Rank | Industry | Average Salary | Hourly Rate |

|---|---|---|---|

| 1 | Finance | $69,369 | $33.35 |

| 2 | Professional | $67,410 | $32.41 |

| 3 | Manufacturing | $64,006 | $30.77 |

| 4 | Technology | $63,375 | $30.47 |

| 5 | Hospitality | $61,226 | $29.44 |

Tax Accountant Related salaries

Tax Accountant Recently added Salaries

| Company | Job | Location | Date Added | Salary |

|---|---|---|---|---|

| Strothman and Company | Staff Tax Accountant | Louisville, KY | 07/24/2022 | $60,000 |

| Deloitte | Sales USE Tax Accountant | Davenport, IA | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Albany, NY | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Louisville, KY | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Colorado Springs, CO | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Darien, CT | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Miami, FL | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Alexandria, VA | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Carson City, NV | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Cleveland, OH | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Madison, WI | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Huntsville, AL | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Frederick, MD | 07/23/2022 | $48,000 |

| Store Space Self Storage | Tax Accountant | Winter Garden, FL | 07/23/2022 | $85,000 |

| Deloitte | Sales USE Tax Accountant | Greenville, SC | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Bentonville, AR | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | San Francisco, CA | 07/23/2022 | $48,000 |

| Sherpa | Tax Accountant | Hickory, NC | 07/23/2022 | $55,000 |

| Deloitte | Sales USE Tax Accountant | Parsippany-Troy Hills, NJ | 07/23/2022 | $48,000 |

| Deloitte | Sales USE Tax Accountant | Bristol, TN | 07/23/2022 | $48,000 |

Tax Accountant Recent user submitted salaries

- $85,000/yrAvg Base Salary

9 days ago by a Tax Accountant with 7 to 9 years of experience

- $42,000/yr Avg Base Salary

9 days ago by a Tax Researcher with 10 to 14 years of experience

- $65,000/yr Avg Base Salary

9 days ago by a Tax Accountant with 1 to 3 years of experience

- $51,000/yr Avg Base Salary

9 days ago by a Tax Accountant with 1 to 3 years of experience

- $73,000/yr Avg Base Salary

9 days ago by a Tax Compliance Accountant with 1 to 3 years of experience

- $67,500/yrAvg Base Salary

Cash Bonus$5,000/yr

10 days ago by a Remote Seasonal Tax Expert with 7 to 9 years of experience

FAQ’s About Tax Accountant Salary

How do I become a tax accountant in USA?

Tax accountants typically earn CPA licensure, which usually requires a bachelor’s degree in an accounting-related field. A bachelor’s degree typically takes four years of full-time study to complete. Though not required for most tax accountant jobs, CPA candidates may attend a master’s in accounting program.

Is tax accountant a good career?

The career path offers strong earning potential

The median annual salary for accountants and auditors in 2021 was $77,250, according to the BLS. For comparison, the 2021 median annual salary for all workers was $45,760.

How do I become a tax practitioner in USA?

How to become a professional tax preparer:

- Create your PTIN. Anyone who prepares tax returns and charges a fee for their services is required to have a Preparer Tax Identification Number (PTIN)

- Apply for an EFIN

- Register with your state

- Work at an office

- Choose a tax prep software.

What is a qualification of tax accountant?

How do I qualify for this Designation? You can qualify if you obtained a three-year Bachelor degree with Tax as a major subject and at least Accounting 3, have three years of verifiable practical experience in a tax environment, and pass the CoTE Professional Tax Examination.

What degree is required to do taxes?

Most tax preparers earn a bachelor’s degree, as well as additional credentials and licensing. The most competitive candidates also possess significant work experience. Luckily, you can enhance your qualifications through continuing education opportunities and certifications.

How long is a tax accountant course?

Duration: One Year. ( It is however possible to pass both modules in one semester).

What skills do tax accountants need?

Required Skills/Abilities:

- Excellent verbal and written communication skills.

- Excellent interpersonal and customer service skills.

- Ability to understand and apply tax laws and changes in the preparation process.

- Excellent organizational skills and attention to detail.

- Accurate math and accounting skills.

What is the duties of tax accountant?

Tax Accountant Duties

Tax accountants work with clients to produce tax return documents that follow laws and regulations. Before tax time, these professionals help clients create a plan to reach their desired financial goals. Throughout the filing process, they keep clients updated on their return information.

Is tax accountant a stressful job?

The job of a tax accountant can be stressful, particularly doing the month of April, but is typically not a physically demanding job.

How much does a Tax Accountant make?

The national average salary for a Tax Accountant is $67,716 per year in United States. Filter by location to see a Tax Accountant salaries in your area. Salaries estimates are based on 2152 salaries submitted anonymously to Glassdoor by a Tax Accountant employees.

What is the highest salary for a Tax Accountant in United States?

The highest salary for a Tax Accountant in United States is $95,708 per year.

What is the lowest salary for a Tax Accountant in United States?

The lowest salary for a Tax Accountant in United States is $47,910 per year

What state pays Tax Accountants the most?

New York pays Tax Accountants the most in the United States, with an average salary of $96,412 per year, or $46.35 per hour.

How do I know if I’m being paid fairly as a Tax Accountant?

You know if you are being paid fairly as a Tax Accountant if your pay is close to the average pay for the state you live in. For example, if you live in New York you should be paid close to $78,256 per year.

What type of Tax Accountant gets paid the most?

Senior Tax Accountant gets paid the most. Senior Tax Accountant made a median salary of $77,537. The best-paid 10 percent make $88,000, while the lowest-paid 10 percent make $67,000.

Conclusion

As you complete your studies and gain experience as a tax accountant, you will likely find that your interests and abilities gravitate toward a certain industry or clientele. Continue to refine your skills in the specialties that you choose, hone your customer service skills, and stay on top of tax law and requirements. In this article above we have mentioned about Tax Accountant Salary in US, their average base salary, their total income and many more.

Tax Accountant Salary in US is averaged around $57,892 USD as of 2022 with 0-2 years of experience

Your career path may also lead you to a different accounting career, such as a management accountant, public accountant, budget director, or internal auditor. Some tax accountants also progress to become top executives and financial managers of corporations, including financial vice presidents, treasurers, controllers, and chief financial officers.