Introduction

The job of a Banking Probationary Officer (PO) remains perhaps the most sought-after position in the banking sector, offering a pathway to a compensating vocation in money and administration. Hopeful competitors strive for these situations in different banks across India, pulled in by the commitment of expert development, dependability, and open doors for having a significant effect in the financial business. This article dives into the subtleties of the Banking PO job, its importance, obligations, profession possibilities, and the excursion it involves for yearning brokers. Here we are talking about Banking Probationary Officer (PO): A Pathway to Financial Leadership.

We are discussing Banking Probationary Officer (PO): A Pathway to Financial Leadership:

Figuring out the Banking Probationary Officer Job

A Banking Probationary Officer, frequently called a Bank PO, is a passage-level administrative situation in banks, especially in open area banks and some confidential area banks. The job includes many obligations, including client support, branch tasks, credit handling, accounting for the board, and dealing with banking items and administrations. Also, Bank POs are endowed with assignments connected with consistency, risk the board, and executing banking arrangements and methods.

Recruitment Cycle and Qualification eligibilities

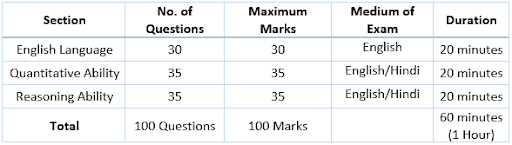

The enlistment cycle for Bank PO positions commonly includes a serious assessment led by banking administrative bodies or banking establishments. The assessment comprises stages, including fundamental assessment, primary assessment, and an individual meeting. Competitors are surveyed on different boundaries, such as fitness, thinking, quantitative abilities, English language capability, and general mindfulness. To qualify for Bank PO positions, applicants should meet specific standards connected with instructive capabilities, age cutoff, and ethnicity, as indicated by the selected bank and administrative specialists.

Training and Probation Period

Upon choice, competitors go through a far-reaching preparation program directed by the separate bank to acquaint them with banking tasks, frameworks, strategies, and techniques. The preparation term shifts from one bank to another; however, it normally lasts for a few months. Following the preparation period, Bank POs are doled out to branches or offices where they go through a probationary period, during which their presentation and reasonableness for the job are assessed. Upon effectively fulfilling the probation time frame, Bank POs are affirmed in their positions and take on undeniable administrative obligations.

Obligations and Responsibilities

Bank POs shoulder a wide exhibit of liabilities to guarantee the smooth working of banking tasks and convey predominant client support. A portion of the critical obligations and undertakings performed by Bank POs include:

- Overseeing client requests, complaints, and record-related administrations.

- Handling advance applications, credit endorsements, and documentation.

- Directing branch activities, cash the board, and security systems.

- Strategically pitching banking items, such as bank accounts, credits, protection, and venture items.

- Carrying out promoting methodologies to draw in new clients and upgrade business development.

- Guaranteeing consistency with administrative rules, inward approaches, and hazard the board conventions.

Vocation Movement and Potential Learning Experiences

A vocation as a Banking Probationary Officer offers sufficient chances for proficient development and progression inside the banking area. Bank POs can advance through the positions by exhibiting execution, authority potential, and space ability. Professional success amazing open doors might incorporate advancements to higher administrative positions like Associate Supervisor, Branch Director, Local Administrator, and others. Furthermore, Bank POs can investigate particular regions inside banking, like credit examination, risk the executives, depository tasks, and advanced banking, by seeking after important accreditations and preparing programs.

Difficulties and Rewards

While the profession of a Banking Probationary Officer offers various prizes, it likewise accompanies its portion of difficulties. Bank POs frequently work in speedy conditions with high jobs and rigid targets. They should explore complex administrative structures, advancing business sector elements and client assumptions while keeping up with functional productivity and consistency guidelines. In any case, the job additionally extends to characteristic rewards like employment opportunity solidness, cutthroat pay, potential open doors for expertise improvement, and the fulfillment of adding to financial consideration and monetary development.

Bank PO FAQ: Figuring out Probationary Officers in Banking

What is a Bank PO?

A Bank PO, short for Probationary Officer, is a passage-level administrative situation in the banking area, especially in open area banks and some confidential area banks. Bank POs assume a significant part in different banking tasks, including client care, branching the board, credit handling, and dealing with banking items.

What is the Recruitment process for Bank PO positions?

The enlistment interaction for Bank PO positions regularly includes a serious assessment led by banking administrative bodies or banking establishments. The assessment comprises various stages, including primer assessment, primary assessment, and an individual meeting. Applicants are evaluated on fitness, thinking, quantitative abilities, English language capability, and general mindfulness.

What are the qualification standards for Bank PO positions?

Candidates must possess Indian nationality and have completed a bachelor’s degree from a recognized institution to apply for a bank PO. The general Age limit for Bank PO is 20 to 30 years.

What is the preparation time frame for Bank POs?

Upon choice, up-and-comers undergo an exhaustive preparation program led by the individual bank to acclimate them to banking tasks, frameworks, strategies, and techniques. The preparation span shifts from one bank to another yet regularly lasts a couple of months. Following the preparation period, Bank POs are doled out to branches or divisions, where they go through a probationary period.

What are the obligations of Bank POs?

Bank POs have assorted liabilities, including overseeing client requests, handling advance applications, administering branch activities, strategically pitching banking items, carrying out advertising procedures, guaranteeing consistency with administrative rules, and keeping up with risk the board conventions.

What are the professional possibilities for Bank POs?

A vocation as a Bank PO offers sufficient chances for proficient development and progression inside the banking area. Bank POs can advance through the positions by exhibiting execution, authority potential, and area aptitude. Professional success potential opens doors and might incorporate advancements to higher administrative positions like Assistant Manager, Branch Manager, Regional Director, and others.

What do Bank POs face a few difficulties?

Bank POs frequently work in speedy conditions with high jobs and tough targets. They should explore complex administrative structures, advancing business sector elements and client assumptions while keeping up with functional proficiency and consistency principles. Be that as it may, the job likewise extends to inborn rewards like employment opportunity security, serious pay, valuable open doors for ability improvement, and the fulfillment of adding to monetary consideration and financial development.

How might people get ready for Bank PO examinations?

People trying to become Bank POs can plan for assessments by concentrating on applicable themes like quantitative fitness, thinking skills, English language capability, general mindfulness, and banking mindfulness. They can sign up for training programs, concentrate on materials and practice papers, and partake in mock tests to improve their planning and execution of the assessments.

Is there a probation period for Bank POs?

Indeed, Bank POs regularly go through a probationary period after finishing their preparation. During this period, their presentation and reasonableness for the job are assessed. Upon fruitful culmination of the probation time frame, Bank POs are affirmed in their positions and take on undeniable administrative obligations.

What are the fundamental abilities expected of Bank POs?

Bank POs require a mix of specialized information, relational abilities, and authority characteristics to succeed in their jobs. Fundamental abilities incorporate logical reasoning, critical skills, relational abilities, cooperation, versatility, honesty, and a client-driven approach. Moreover, capability in PC applications and monetary examination apparatuses is functional for Bank POs to fulfill their obligations successfully.

Conclusion

A profession as a Banking Probationary Officer addresses a door to a satisfying and dynamic vocation in the banking area. Bank POs play a vital part in driving the development and outcome of banks by providing administration, development, and client-driven arrangements. Hopeful brokers who leave on this excursion can anticipate a remunerating vocation with open doors for learning, development, and a constructive outcome in money.