Introduction

The Life Insurance Corporation of India (LIC) remains a foundation of the Indian insurance industry, assuming an urgent role in shielding the Financial well-being of millions of people and families in the nation. Established in 1956, LIC has since been inseparable from trust, unwavering quality, and security in disaster protection. We are talking about Life Insurance Corporation of India (LIC).

Here, we are discussing about Life Insurance Corporation of India (LIC):

Full Structure and History

LIC, the abbreviation for Life Insurance Corporation of India, was laid out on September 1, 1956, following the nationalization of the insurance business in India. Preceding its development, the insurance area was overwhelmed by private players, and there was an absence of far and wide admittance to insurance policies, particularly among the vulnerable segments of society. The making of LIC denoted a massive achievement in improving India’s insurance area,

Operations and Design

LIC is a state-possessed insurance agency that is the responsibility of the Indian Legislature. Its capabilities as a legal company are represented by the Life Insurance Corporation Act of 1956. The company’s central office is in Mumbai, Maharashtra, and it operates through a massive organization of branches and workplaces across the country.

LIC offers various insurance policies to take care of the different necessities of its clients, including term protection plans, gift plans, entire life plans, cash-back plans, benefits plans, and unit-linked insurance plans (ULIPs). These items give monetary assurance, reserve funds, and speculation valuable open doors to policyholders, assisting them with accomplishing their drawn-out monetary objectives and securing the eventual fate of their families.

Key Items and Administrations

Term Protection Plans: Term protection plans offer unadulterated life cover for a predetermined period, giving monetary security to the policyholder’s family in case of their untimely death.

Endowment Plans: Enrichment plans combine insurance inclusion with reserve funds and speculation parts, offering a single payout to the policyholder toward the end of the contract term or upon development, alongside rewards.

Whole Life Plans: Entire life plans give deep-rooted protection inclusion, with the aggregate guaranteed payable to the chosen one upon the policyholder’s downfall, alongside gathered rewards, if any.

Money-Back Plans: Cash-back plans offer intermittent payouts to the policyholder during the approach term, giving liquidity at standard stretches while guaranteeing life inclusion.

Pension Plans: Benefits plans, or retirement plans, offer monetary security and customary pay post-retirement, empowering policyholders to maintain their lifestyles during their golden years.

Unit-Connected Protection Plans (ULIPs): ULIPs join extra security inclusion with venture choices in value and obligation reserves, permitting policyholders to participate in the capital business sectors while getting a charge out of protection security.

Influence on Society

LIC’s effect on Indian culture has been significant, reaching out past the protection domain to include government-managed retirement, monetary consideration, and financial turn of events. A few critical parts of LIC’s cultural effect include:

Financial Inclusion: LIC has had an immediate impact on advancing monetary consideration by offering reasonable life coverage items to people across metropolitan and rural regions, consequently giving them access to formal monetary administrations and risk security.

Social Security: LIC’s disaster protection items provide a safety net to families, guaranteeing monetary soundness and security in case of the policyholder’s death. This has relieved the financial effect of inauspicious passings and given a feeling of confirmation to many families.

Employment Generation: LIC’s tremendous organization of branches and workplaces has opened business doors for an enormous labor force, including protection specialists, regulatory staff, and administrative faculty, adding to work creation and monetary development.

Investment in Infrastructure: LIC channels a large part of its assets into foundation tasks and government protections, supporting framework improvement drives and cultivating monetary advancement.

Promotion of Reserve funds and Investment: LIC’s protection cum-venture items urge people to save and contribute for the future, advancing a culture of monetary discipline and abundance creation among policyholders.

Difficulties and Valuable Open Doors

While LIC has made critical commitments to India’s protection area and financial turn of events, it additionally faces specific difficulties and open doors:

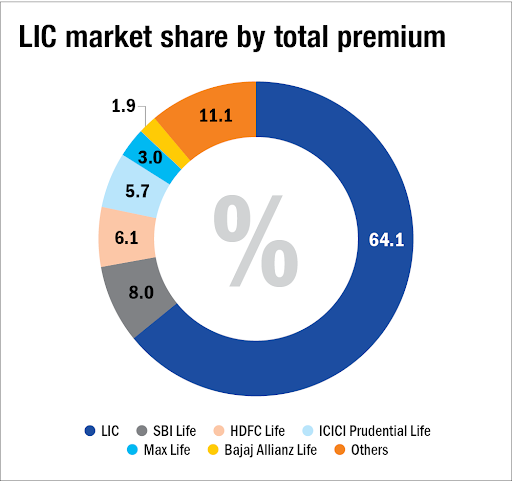

Competition: LIC operates in a profoundly cutthroat climate, confronting fierce opposition from private backup plans offering creative items and administrations. LIC should adjust to changing client inclinations and market elements to keep up with its market initiative.

Technology Adoption: With the advent of computerized innovation and online stages, there is a growing requirement for LIC to embrace advanced change and upgrade its advanced capacities to develop client care further, smooth out tasks, and contact new client segments.

Regulatory Compliance: LIC operates under the Insurance Regulatory and Development Authority of India (IRDAI) guidelines. Compliance with regulatory requirements and adherence to prudential norms are essential for maintaining the trust and confidence of policyholders and stakeholders.

Customer Service: LIC must prioritize client support and upgrade the general client experience to retain current policyholders and attract new clients. This requires an interest in innovation, preparation, and administration quality drives.

Innovation and Item Development: LIC should consistently enhance and foster new items and administrations that meet its clients’ necessities and inclinations in a rapidly advancing business sector. This includes statistical surveying, item customization, and dexterous item advancement processes.

FAQs

What is LIC?

Life Insurance Corporation of India (LIC) is a state-owned insurance agency established in 1956 following the nationalization of the insurance business in India. It is the biggest insurance company in India and operates as a statutory corporation under the government’s ownership.

What does LIC offer?

LIC offers various life insurance products, including term protection, enrichment, entire life plans, cash-back plans, benefits plans, and unit-linked insurance plans (ULIPs). These products provide policyholders with monetary insurance, reserve funds, and excellent venture opportunities.

What is the meaning of LIC in India?

LIC is vital in advancing monetary consideration, government-managed retirement, and financial improvement in India. It offers reasonable life coverage items to people across metropolitan and rural regions, giving them access to formal monetary administrations and chance security.

How does LIC add to social security?

LIC’s life coverage items provide a safety net to families, guaranteeing monetary dependability and security in case of the policyholder’s destruction. This mitigates the financial effect of less-than-ideal passings and affirms many families.

How does LIC influence employment generation?

LIC’s immense organization of branches and workplaces opens business doors for a large workforce, including protection specialists, regulatory staff, and administrative faculty. This adds to job creation and monetary development in India.

What difficulties does LIC face?

LIC faces difficulties, such as fierce opposition from private backup plans, the need to embrace advanced innovation and improve client support, consistency with administrative prerequisites, and advancement in item advancement to meet developing client needs.

How does LIC guarantee client satisfaction?

LIC centers around giving predominant client support and upgrading the general client experience through an interest in innovation, preparation, and administration quality drives. It means holding existing policyholders and attracting new clients by offering responsive and proficient administrations.

How does LIC guarantee monetary stability?

LIC channels a large part of its assets into foundation tasks and government protections, supporting framework improvement drives and cultivating financial advancement. It additionally adheres to administrative necessities and prudential standards to maintain monetary dependability and the trust of policyholders and partners.

Is LIC regulated?

Indeed, LIC works in a directed climate represented by the Insurance Regulatory and Development Authority of India (IRDAI). Consistency with administrative prerequisites and adherence to prudential standards are fundamental for LIC to keep up with the trust and certainty of its policyholders and partners.

What is LIC’s standpoint for the future?

Despite challenges, LIC presents opportunities for development and advancement in the protection business. By embracing computerized change, upgrading client support, consenting to administrative prerequisites, and enhancing item improvement, LIC expects to support its administrative role and contribute to India’s financial turn of events.

Conclusion

The Life Insurance Corporation of India (LIC) has had a critical impact in molding India’s protection area and adding to the country’s financial turn of events. As a believed supplier of life coverage items and administrations, LIC has given many people and families across India monetary security, social insurance, and inner harmony. While confronting difficulties like rivalry, innovation reception, and administrative consistency, LIC presents open doors for development and advancement in the powerful scene of the protection business.