BOT is an acronym that stands for “Build-Operate-Transfer.” It refers to a public-private partnership (PPP) model used to finance and develop large infrastructure projects, such as highways, airports, and power plants.

In this model, a private company, known as the “developer,” is responsible for financing, constructing, and operating the project for a specific period, after which ownership and control are transferred to the government.

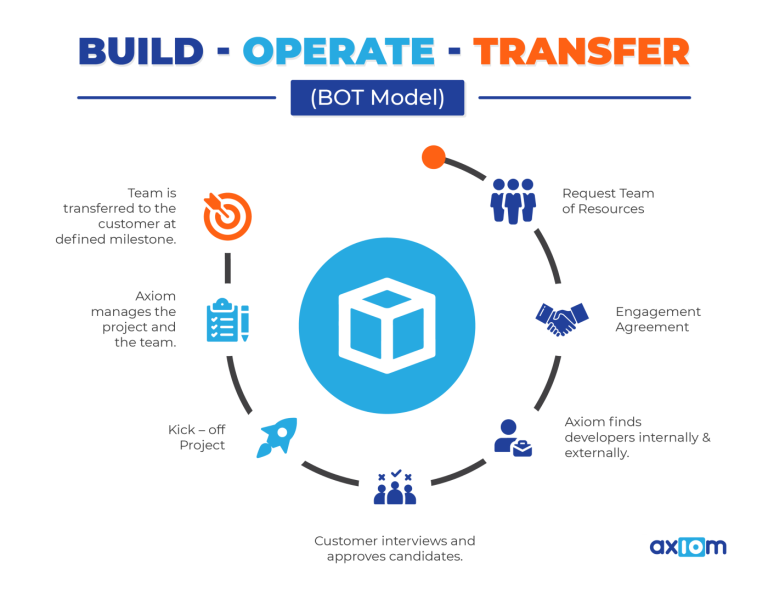

Understanding the Build-Operate-Transfer (BOT) Model

The BOT model was developed as a way to address the funding gap for infrastructure development in many countries. It allows the government to leverage the expertise and resources of the private sector to finance and develop large projects without incurring significant debt or relying solely on public funds.

Under the BOT model, the government typically grants a concession or license to a private developer to finance, design, construct, and operate the infrastructure project for a specific period, usually 20-30 years. The developer is responsible for securing financing for the project, as well as managing the construction, operation, and maintenance of the asset during the concession period.

The developer earns revenue from the project through fees or tolls charged to users of the infrastructure, such as motorists on a highway or passengers at an airport. The revenue generated is used to repay the project financing and generate a return on investment for the developer.

At the end of the concession period, ownership and control of the asset are transferred to the government, and the developer is typically required to hand over the asset in good condition.

Advantages and Disadvantages of the BOT Model

The BOT model has several advantages, including:

- Increased private sector participation: By involving the private sector in infrastructure development, the government can access the expertise, technology, and financial resources of the private sector to develop infrastructure more efficiently.

- Reduced government debt: By using private sector financing, the government can reduce its debt burden and avoid relying solely on public funds to develop infrastructure.

- Improved risk management: The developer assumes much of the risk associated with the project, including financing, construction, and operation risks. This reduces the government’s exposure to risk and ensures that the private sector has a strong incentive to deliver the project on time, within budget, and to the required quality standards.

However, the BOT model also has several disadvantages, including:

- Increased project costs: The private developer must earn a return on investment, which may increase the cost of the project for users of the infrastructure.

- Long concession periods: Concession periods are typically long (20-30 years), which means that users of the infrastructure may be subject to tolls or fees for an extended period.

- Limited public control: The government has limited control over the project during the concession period, which may lead to concerns about the quality of the infrastructure, maintenance, and pricing.

Conclusion

The Build-Operate-Transfer (BOT) model is a popular PPP model used to finance and develop large infrastructure projects. While the model has several advantages, including increased private sector participation and reduced government debt, it also has several disadvantages, including increased project costs and limited public control. As such, it is important for governments to carefully consider the advantages and disadvantages of the BOT model when deciding whether to use it to finance and develop infrastructure.